When you file a claim for an injury, you should know what defenses the insurance company might use to lower or deny your payment. Insurance companies often care more about keeping their money than paying out claims, so they have come up with different ways to do this. Being aware of these common defenses can help you prepare for problems that may arise in your case.

How Insurance Companies Usually Deal with Claims

One of the most common ways for insurance companies to protect themselves is to ask how bad the injury is. They could say that the injury was already there or that it wasn’t as bad as they say it is. People who are making claims may have a hard time proving how bad the injury was and how the accident caused it.

Another common defense is to say that the reasons for the denial are related to the policy terms. Insurance companies might say that the policy didn’t cover the accident or that the policyholder didn’t follow the right steps, like not reporting the accident within a certain amount of time. They might also say that the claimant’s actions led to the incident or that they were partly to blame.

Not agreeing on what caused the injury

In many cases, insurance companies try to show that the accident didn’t cause the injury. The insurance company might hire experts or use their own medical evaluations to challenge what the person making the claim says happened. They might say that the accident in question didn’t cause the injury, which would lower their responsibility and the amount of money they have to pay.

Reducing Damages

Another tactic used by insurance companies is to say that the person who filed the claim didn’t do enough to lessen their damages. This means that the insurance company says the injured person didn’t do what they could to get better or lessen the severity of their injury. Insurance companies may also say that the claimant’s injuries got worse because of things they did or didn’t do after the accident.

Questions and Answers

What are some common ways that insurance companies fight injury claims?

Insurance companies often say that the injury was already there, that it wasn’t as bad as the person said it was, or that it wasn’t covered by the policy.

How do insurance companies argue about what caused an injury?

They might hire experts or use medical tests to argue that the claimant’s version of events is wrong and that something else caused the injury.

What does it mean when insurance companies say you didn’t do enough to lessen your damages?

This means that the insurance company says the claimant didn’t do enough to lessen the severity of their injuries or speed up their recovery.

Is it possible for insurance companies to deny a claim because of the terms of the policy?

Yes, insurance companies often deny claims by saying that the event isn’t covered by the policy or that the person who made the claim didn’t follow the right steps.

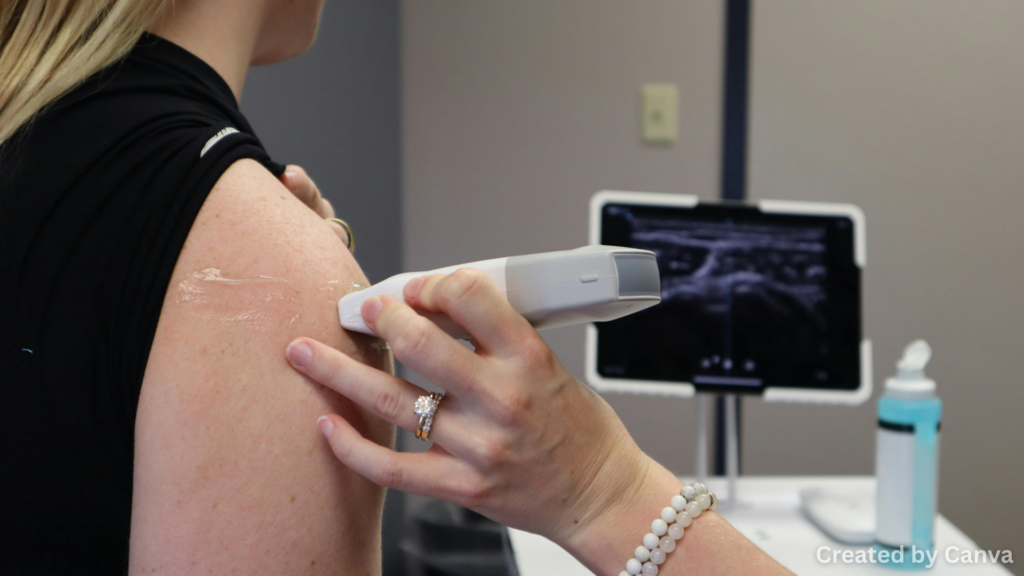

Featured Image

Images are by Canva.com

Read more about: Can You File a Personal Injury Claim After a Car Accident Without Police Reports?